Brilliant Strategies Of Info About How To Buy Commodity Futures

Buying oil stocks or shares of an energy or oil etf will give you indirect exposure to the oil market, while trading oil futures more closely tracks the underlying crude oil market.

How to buy commodity futures. Some online brokers will allow you to set up a virtual account that trades with fake money. Using an online trade ticket for futures, enter the underlying symbol to find and select the specific futures contract you want to trade, then confirm the order details and submit the order. The buyer of the futures contract accepts the.

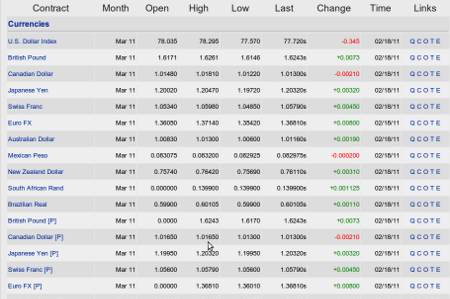

Ad a diverse offering of futures & futures options products. With the buying or selling of. Investors can use products like commodity etfs and futures to add commodity exposure to their portfolios.

The price of commodities is highly affected by the demand and economic development in multiple countries around the globe. If the market moves in our favor and hits the order, we make a profit of $3,300 ($12.50 per tick x 264). Commodity futures traders enter into a legal agreement to buy/sell a commodity at a predetermined price on a set future date.

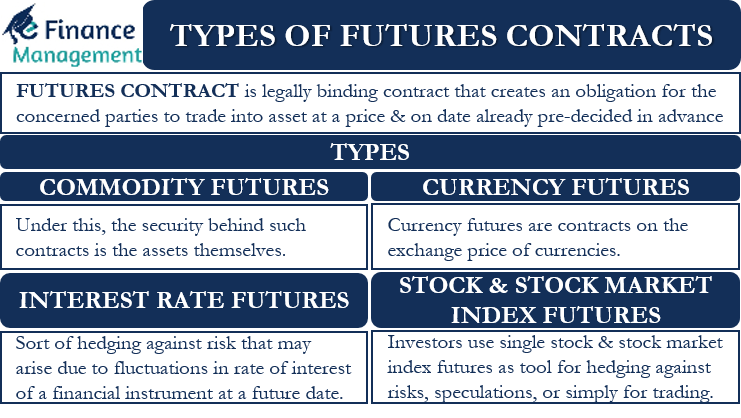

Conversely, we incur a $1,250 loss if we get stopped out. A futures contract is a legal agreement to buy or sell a particular. You can either buy or sell a contract for a commodity’s spot price with the expectation the price will rise or fall.

Futures contracts work buy speculating on the price in a future time. Using futures to invest in commodities. One way to invest in commodities is through a futures contract.

Use a virtual trading account to practice trading. The best time to buy commodities is typically.

/futures-contract-4195880-01-final-02f6e035093b402fa53b5ade43f0760a.png)