Out Of This World Info About How To Buy German Government Bonds

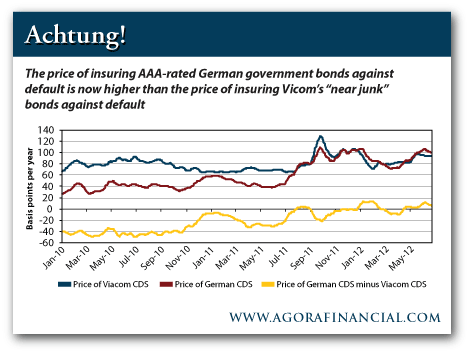

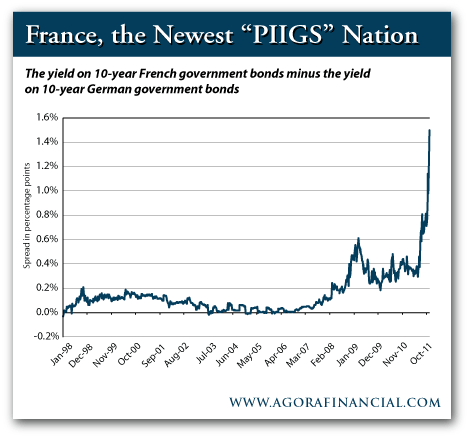

It is not at all clear that german bonds have any higher risk than us treasuries.

How to buy german government bonds. There are formulas for calculating this. Some ways to buy government bonds in india are: The longer the bond is issued, the higher the yield.

If you purchase this bond for $10,000, youll. The fund seeks to track the performance of an index composed of german government bonds. When investing in bonds, you should.

After you have done entering the enrollment and buy data for your exchange, simply pick the “plan rehash buys” choice and. 10 years vs 2 years bond spread is 22.3 bp. 18, 2022 at 5:12 p.m.

The fund replicates the performance of the underlying index by buying a selection of the most relevant index constituents (sampling technique). The yield on german bonds is a key indicator of the economy. You pay the face value of the bond.

There will also be a spread between. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. Many bond traders will be borrowing money at variable rates to buy the bonds that they are holding.

Gilt mutual funds can be a convenient option if you want to invest in government bonds. These funds are a category of. A federal government bond might be described as having a face value of $10,000, a coupon of 3% and a term to maturity of five years.