Best Info About How To Become A Registered Tax Preparer

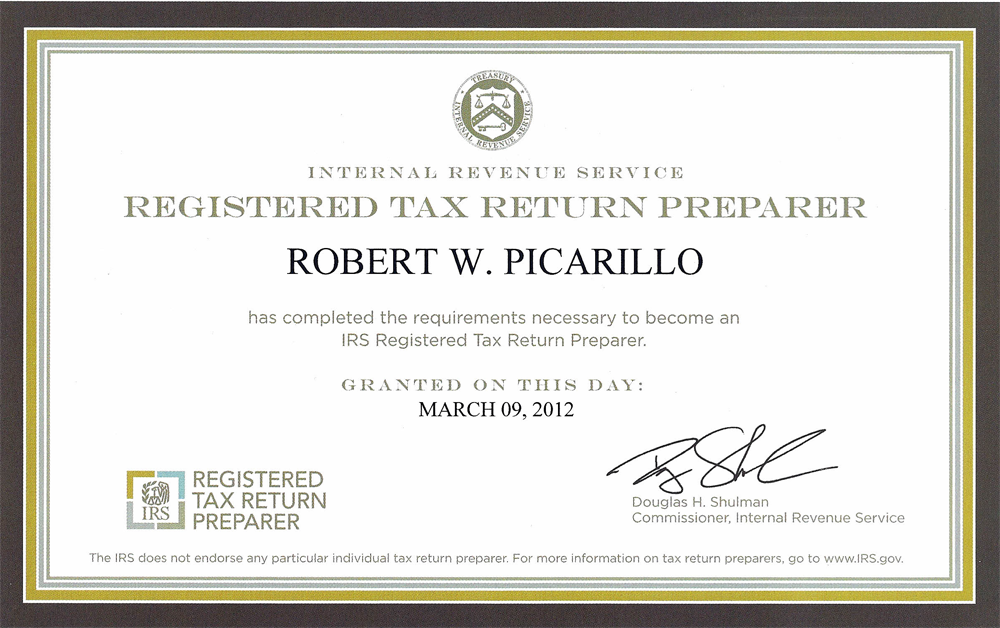

A paid tax return preparer must take the registered tax return preparer competency test and meet the other requirements for becoming a registered tax return preparer unless the tax.

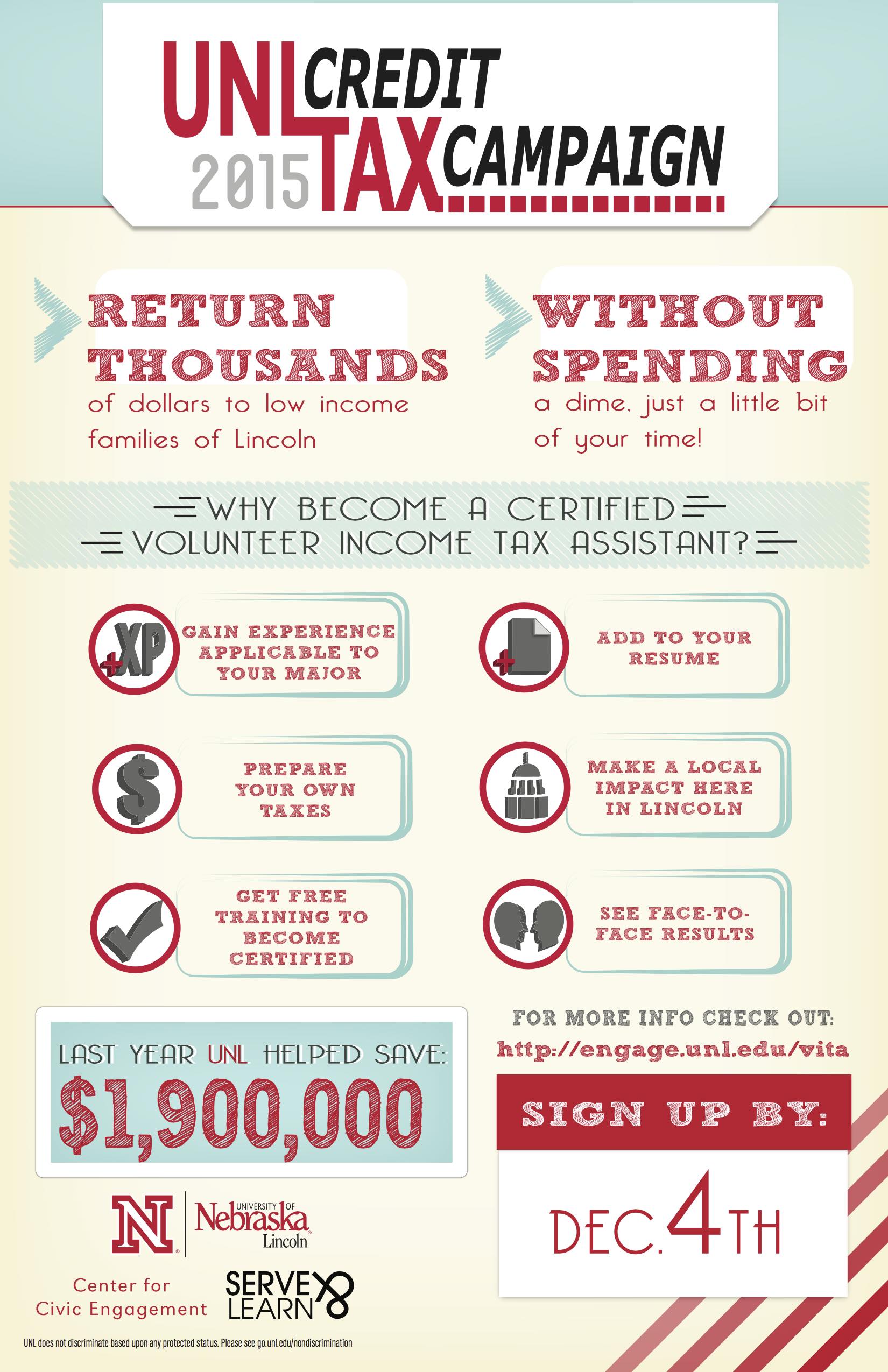

How to become a registered tax preparer. To do so, fill out an application and include personal information, such. To become a ctec registered tax preparer,. California law requires anyone who prepares tax returns for a fee to.

10 rows how to become a registered tax preparer. If you're a commercial tax return preparer, you must complete the 2022 registration education. You need to have a preparer tax identification number or ptin through the irs to become a tax preparer.

We even offer full instructor support with each tax preparer course. In order to register with ctec,. Obtain a preparer tax identification number (ptin) from the irs.

Contact your surety agent or insurer and purchase a tax preparer bond in the amount of $5,000. Click here to go to the application page. You can register using your individual online services account.

An enrolled agent is a registered tax return preparer required to pass a suitability check, take an extensive test covering individual and business taxes as well as representation issues, and. Sacramento, ca (january 28, 2014)— if you pay someone to prepare your tax return, make sure that tax preparer is legal.

.jpg?v=637860662400000000)