Who Else Wants Tips About How To Choose Investment Funds

Investment objective refers to an investor’s financial goal which he/she aims to accomplish with the.

How to choose investment funds. A mutual fund is a type of investment product where the funds of many investors are pooled into an investment product. The stock market is a particularly popular option since there are so many investment opportunities from which to choose. A good starting point can.

From the off, it’s worth deciding whether to invest lump sums or regular, smaller amounts. Otherwise, your contributions will sit in a money market account. Ad choose from over 50 funds with 4 & 5 star ratings from morningstar.

4) work out a style and choose your investment vehicle. First and foremost, a mutual fund is professionally managed. Factors for selecting a mutual fund category.

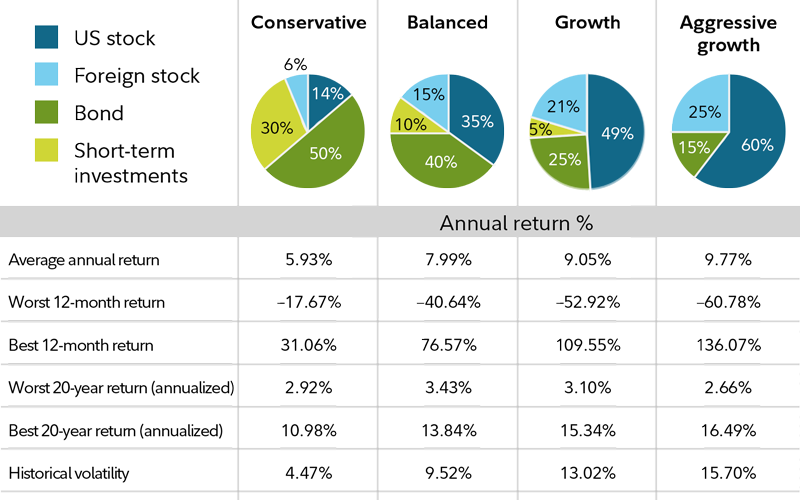

A less aggressive investment mix, meaning one with a lower allocation to stocks, should typically generate slightly lower returns (on average) over the long run. How to pick investments for your 401 (k): Mutual funds, retirement, & investing solutions.

Find the right fund based on your approximate retirement date, and the fund will invest in an appropriate asset allocation, then modify the mix. Stocks and bonds are pieces of ownership in. We offer a variety of investment options for your retirement.

Some providers make this really easy for you by providing a. In keeping with the pareto principle, we’ll consider the five most. Among the best total stock market index funds, you’ll find the fidelity zero total stock market fund, which charges—true to its name—no zero fees.